What Are Stocks and How Do They Work?

7 Min Read | Sep 6, 2023

Did you ever hear the story about the tortoise and the hare when you were a kid? Believe it or not, there's something to learn about investing from this little tale. There’s a fast and reckless way to approach buying stocks (the hare) and a slow and steady way (the tortoise). Stocks are a powerful wealth-building tool, but they can also delay your progress and cost you a lot of money and heartache without the proper caution.

So let’s jump into the details, starting with: What are stocks? And how do they work?

What Are Stocks?

Stocks represent shares (or tiny pieces) of a company. When a company goes public, they sell these small shares to people in order to fund growth. Picture a big ol’ sheet cake that someone cuts up into lots of small squares. If you purchase one of those squares, you own that slice. When you buy stocks, you actually become a part owner of the company!

Buying stocks is one of the most common investment strategies. Over time, the value of the stock will (hopefully) grow and produce a return on your initial investment. The value of any given stock is tied to the performance of the company and how it is perceived by consumers. Because of that, some stocks are more volatile than others, meaning that their price rises and falls quickly.

Buying stocks always carries risk. If the company goes south, you could lose all the money you invested. This doesn’t mean you shouldn’t invest, but it does mean that you should invest the right way and never take on unnecessary risk.

What Is the Stock Market?

If stocks are shares of companies, and markets are places where things are bought and sold, then the stock market is where brokers buy, sell and trade stocks! Pretty simple, right?

Stockbrokers are people who buy and sell stocks, usually on behalf of clients they represent or funds they manage. They’re always watching stock market activity and tracking real-time updates to how the stocks are performing.

The stock market isn’t necessarily a physical location, although the New York Stock Exchange (NYSE) is house in an actual building on Wall Street. The Nasdaq is an electronic exchange where brokers communicate through computers to buy and sell.

If you pay any attention to financial news, you’ll hear a lot about the Dow. It’s short for the Dow Jones Industrial Average, which is a list of 30 large public companies that are traded on the NYSE and the Nasdaq. It’s basically a quick reference to how top companies are performing.

Types of Stocks

All stocks are shares of a company, but they can be packaged and sold differently to people who want to invest.

Single Stocks

Buying single stocks gives you ownership in a specific company. Because they’re extremely risky, we would caution against investing in single stocks. It’s better to diversify your money than put it in one particular company. If you’re already investing 15% of your income in growth stock mutual funds, then you can consider single stocks as an additional investment. But never let them make up more than 10% of your portfolio, and be prepared to lose money if the company you’re invested in takes a nose dive.

Exchange-Traded Funds

Exchange-traded funds (ETFs) are very similar to mutual funds, filled with stocks from many different companies . . . except they’re bought and sold like single stocks.

Most ETFs are also like index funds—they’re filled with stocks from high-performing companies known for being reliable investments, like Amazon, Microsoft, Apple and The Home Depot. They’re often referred to as blue-chip companies, because in the game of poker, the blue chip has the highest value.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

ETFs are passive funds, meaning that no one is managing your investments for you. You won’t pay fees to have someone look out for your investment, but the trade-off is that you’re on your own. Only after you’ve maxed out your retirement accounts should you even think about investing in low turnover ETFs inside of a taxable investment account.

Mutual Funds

The best way to invest for long-term, consistent growth is to put your money into mutual funds. A mutual fund is created when a group of people have pooled their money together to buy stocks in different companies.

Mutual funds create built-in diversification for your investment by spreading your money out. Some of the funds will go up, and some will go down, but the historical long-term growth rate of the stock market is 11%.1 That means that if you select good, growth-stock mutual funds, you can expect the value of your investments to grow over the long term.

Unlike ETFs, mutual funds are actively managed, meaning that an investment professional is making decisions about how to invest the fund’s money. Also, there are thousands of different types of mutual funds. Be sure and sit down with an investment professional when you’re choosing specific funds.

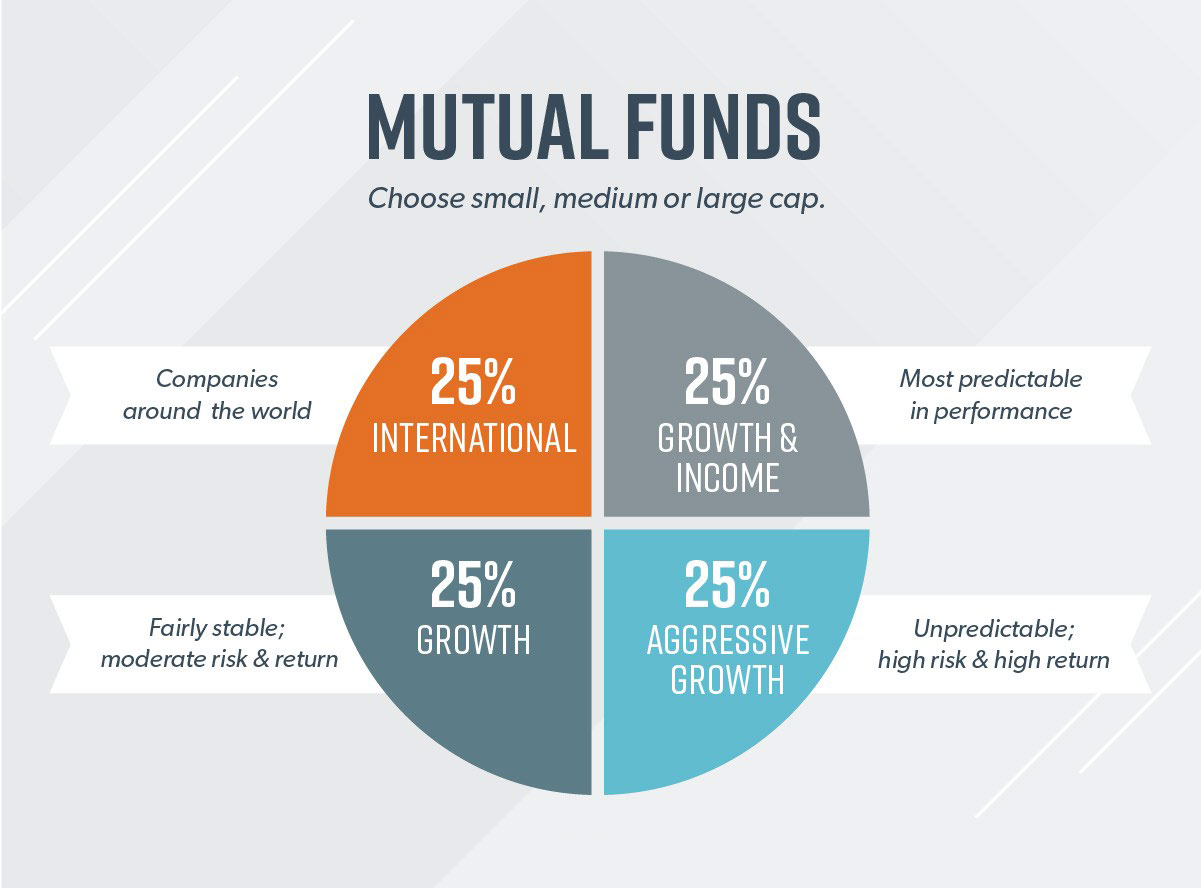

The four main types of mutual funds that we recommend are:

- Growth and income funds: These are the most predictable funds in terms of their market performance.

- Growth funds: These are fairly stable funds in growing companies. Risk and reward are moderate.

- Aggressive growth funds: These are the wild-child funds. You’re never sure what they’re going to do, which makes them high-risk, high-return funds.

- International funds: These are funds from companies around the world and outside your home country.

Allot 25% of your investment money to each of these four funds, and boom—you’re diversified!

Stock Market Capitalization

Have you heard the word cap to describe mutual funds? That word is short for capitalization, which classifies how much a company is worth. Here are the categories:

- Small-cap: companies valued below $2 billion

- Mid-cap: companies valued between $2–10 billion

- Large-cap: companies valued over $10 billion

Now, let’s put this together with an example. A large-cap, growth stock mutual fund is made up of big companies (worth more than $10 billion) that are growing (like Amazon, Facebook, Microsoft). A small-cap, aggressive growth fund is made up of small companies (like tech start-ups) that have a high chance of financial gains, but also a high chance of failure.

How to Make Money on Stocks

When it comes to single stocks, people try to follow this rule of thumb: buy low, sell high. You want to buy a share of a company when it’s inexpensive, then sell it later at a profit. Another way people make money on stocks is by collecting dividends, which means a company pays stockholders a regular share of the company’s earnings.

But “playing the stock market” with single stocks is just a sophisticated game of poker. The best way to make money on stocks is by investing in growth stock mutual funds and patiently waiting. Having a long-term approach to investing allows the two most powerful forces in all of finance to work together: time and compound interest. The best way to invest consistently in mutual funds is by contributing to your workplace 401(k) and/or a Roth IRA.

There’s a difference between building wealth and getting rich. The marketplace is like a roller coaster, but your job is to ride it out and be patient. The worst decision you can make when you’re on a roller coaster is to get off in the middle of the ride!

Should I Invest in Stocks?

Although we don’t recommend single stocks, we do recommend that you invest in growth stock mutual funds. Chances are, your company’s 401(k) plan is full of them! This is the best place to start investing since it’s an easy and automatic process. In addition to your workplace account, you can open a Roth IRA to take advantage of tax-free growth.

Hear us on this: Investing is important! We must grow our money. Stuffing it under a mattress or burying it in your backyard like a pirate will not keep up with inflation.

A qualified investment professional can help you get started and make a plan. Find a qualified investing professional in your area today!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.