Am I on Track for Retirement? Milestones for Every Generation

5 Min Read | Sep 6, 2023

Because building wealth is a marathon, staying focused for decades can feel daunting and discouraging. The finish line feels distant, so it’s easy to get distracted by other pressing financial needs. To stay focused, it’s helpful to have milestones to look at—markers to track your progress and keep you motivated.

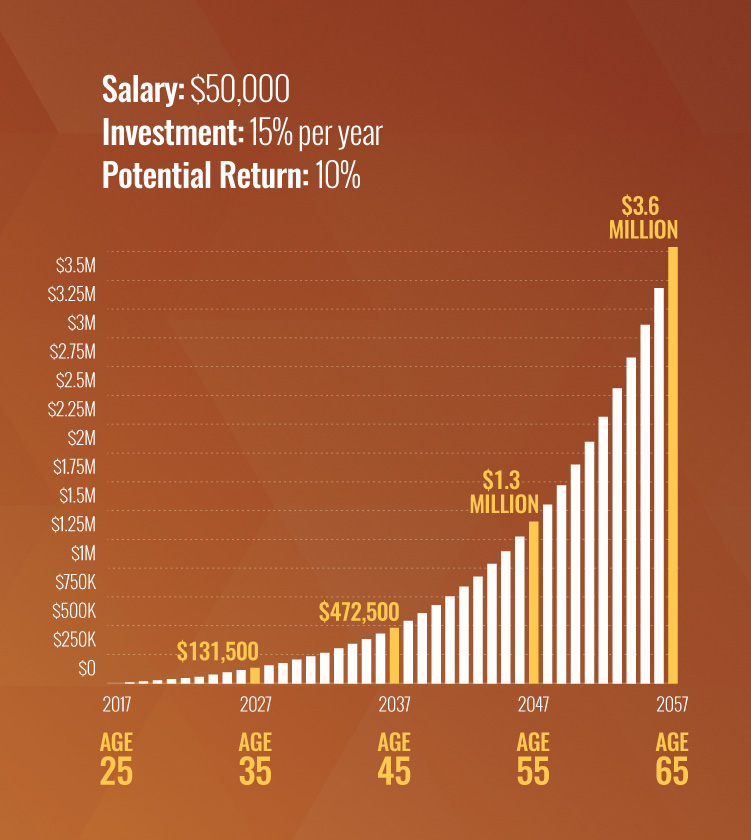

Below are some markers you can use to check in with your retirement savings. These are just rough estimates. Keep in mind that the numbers are based on a 10% rate of return over 40 years, which means you started investing at age 25. If you don’t start investing until age 35, you can reach the same milestones; you’ll just reach them 10 years later.

How Gen Y Could Become the Richest Group in the U.S.

You can do what other generations haven’t done—you can start investing early. In fact, you can start investing long before you get your first “real” job. If you managed to put away $50 a month from age 18–25, you’ll have about $6,000 in a retirement account. Now if you left that $6,000 alone from age 25–65, you’d have an extra $270,000—which could cover your health care in your older years! When you get that job out of college, you’re already ahead of the game and can add to that amount.

Savings Milestones for Millennials (Born 1980–1997)

By age 25, you should be nearing the end of your college years and entering the workforce. If you have any debt, pay it off as soon as possible—even before you start investing. As soon as you are debt-free and have an emergency fund in place, start investing! You want to save 15% of your income. On a $50,000 annual salary, investing 15% of your income would be $7,500 a year or $625 a month.

If you invest $7,500 a year for 30 years starting at age 25, you’ll have $1.3 million by age 55! If you want to hit $1 million by age 55 but don’t start investing until you’re 35, you’d need to invest $16,800 a year. That’s because you lost 10 years of saving and 10 years of compound interest. That’s why it’s so important to start saving early. If your income is below $50,000 annually, no worries. Read more about building a solid retirement on a smaller salary here.

Savings Goals for Gen Xers (Born 1965–1979)

If you haven’t started investing yet, now is the time to take action! You can catch up if you make sacrifices and decide that living like your peers now (up to your eyeballs in debt) isn’t a good plan for your future.

If you’re 35 years old right now and you started investing $625 a month at age 25, you likely have around $131,000 in your retirement fund.

If you’re 45 years old right now and you started investing that $625 a month at age 25, you should be around $472,000 right now.

Not everybody invests 15% of their income beginning at age 25. We get that! But that doesn’t mean you can’t reach that millionaire milestone! However, if you’re way behind at age 45, you’d need to contribute significantly more money each month to get there. You might also want to wait until age 70 to retire.

If you started investing $800 a month from age 45 to 70, you’d hit the million-dollar mark at age 70! See! You can catch up!

You may need to cut your budget to the bone, sell some stuff, or even get a second job for a while. We know some of these choices may seem extreme, but you may need to take drastic measures in order to turbo-start your retirement from zero!

Savings Targets for Baby Boomers (Born 1946–1964) and Beyond

At this point, you’re beginning to hit your savings goals, but this is no time to let off the gas! We know you want to relax a little bit and enjoy the fruits of your hard work, especially if you’re nearing the $1 million mark. We get it. It’s okay to live a little and save for the future. Just don’t let five minutes of stupid set you back 10 years in retirement savings. You’re just one speedboat away from disaster, so stay focused!

How much will you need for retirement? Find out with this free tool!

If you’re 55 years old right now, and if you started saving $625 a month at age 25, you should have about $1.3 million. Congratulations!

If you’re 65 years old right now and you’ve saved $625 a month for 40 years, you should have about $3.6 million!

Check out the chart below that illustrates all the milestones by age:

And don’t get hung up on rate of return. Even if it was only 6%, which is far below the average 30-year return of the S&P 500, you’d still have more than $1.2 million by age 65! It’s about being intentional.

If you’re still way behind on your savings at this point, you may need to downsize your home. Or you may need to adjust your expectations about retirement. You may need to work longer, and you may not be able to take those fancy vacations. But if you do some hard work, you can still enjoy this chapter of your life. Check out our investment calculator to find out where you are and how to develop a solid plan!

These milestones are just ballpark figures. To get a more personalized number, talk with your investing professional about your goals and current situation. They can give you a clearer picture about the steps you need to take at every stage of your life.

A secure retirement doesn’t just happen. You can’t keep doing what you’ve been doing and expect different results, so set your goals, work toward them, and don’t let anything get in your way!

Find a SmartVestor Pro!

Don't let anything get in your way of a secure retirement. Contact a SmartVestor pro who can help!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.