Recent Episodes

Thursday, April 25

Dealing With Debt

Thursday, April 25

Navigating Family and Money

Thursday, April 25

Is It Ever a Good Idea To Get a Prenup?

Wednesday, April 24

This Might Be a $100K Stupid Tax

Wednesday, April 24

Tackling Debt in Collections

Wednesday, April 24

How Can I Start Being Financially Responsible?

Tuesday, April 23

Should We Rent Forever?

Tuesday, April 23

Is It Ever Worth Taking On Debt?

Tuesday, April 23

Is It Okay To Ask My Kids To Help Pay Bills?

Monday, April 22

There Are No Shortcuts to Financial Responsibility

Monday, April 22

Real Estate Investing Isn't All Rainbows & Paychecks

Monday, April 22

How Do We Pay Off Debt With a Low Income?

Play More Episodes

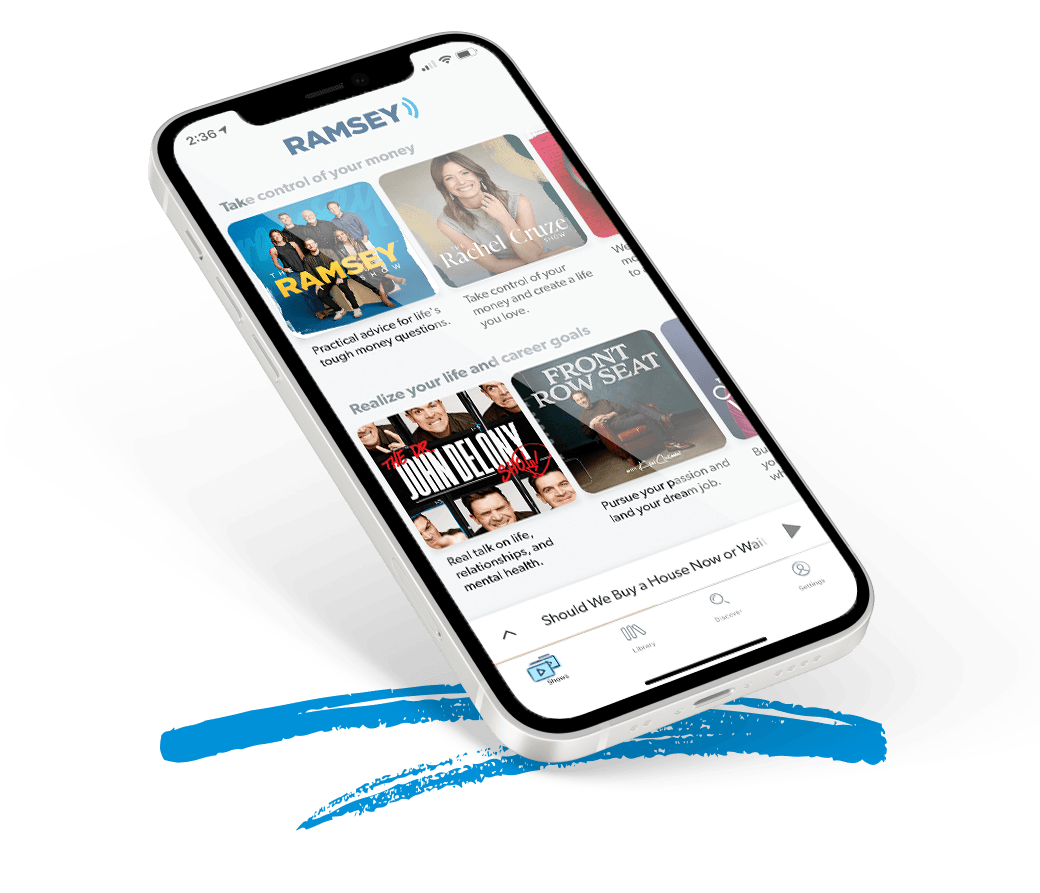

All your favorite shows now in one app.

With the Ramsey Network App you can listen to Dave Ramsey, Ken Coleman, Rachel Cruze, EntreLeadership, Borrowed Future and more!

Visit Ramsey HQ

Visit the lobby, get a picture with Dave, and stop by Baker Street Cafe.

Be on the Show

Have you recently paid off all your debt or become an Everyday Millionaire? We're looking for people like you to share your story on air! You can call in and be featured on the show or come to Ramsey HQ to do a Debt-Free Scream live in the lobby!

About The Ramsey Show

Dave Ramsey started on one station in Nashville back in 1992, sharing practical answers for life’s tough money questions. Today, the show reaches over 18 million combined weekly listeners. He’s also the author of seven bestselling books and has reached over 1 million people through Ramsey Solutions live events. A lot has changed through the years, but Dave and his team's practical advice on life and money has remained consistent.

SimpliSafe Home Security

One of the most important things you can do is protect your home and family in case of an emergency. SimpliSafe Home Security offers comprehensive protection against break-ins, fires, floods and more. And their industry-leading 24/7 professional monitoring is just a buck a day—less than half the cost of traditional home security.

SimpliSafe is professionally monitored and will send police, fire, or medical professionals when danger is detected. SimpliSafe alarms are easy to purchase directly online and easy to install yourself. Plus, there are no contracts and no hidden fees—because who wants those? Not Ramsey fans, for sure.

Visit SimpliSafeDirect.com and get 20% off your entire new system and first month of monitoring FREE when you enroll in Interactive Monitoring.

Christian Healthcare Ministries

Thousands of families all over the country are discovering an affordable, biblically based way of meeting healthcare costs: Christian Healthcare Ministries. CHM isn’t health insurance; they’re a health cost-sharing ministry that gives members the freedom to choose the doctors and providers they want for approved treatments—without all the frustration of worrying about networks.

CHM has helped members satisfy nearly $10 billion in healthcare costs. You can join CHM at any time, so no waiting around for open enrollment. Find out more about the only health cost-sharing option Ramsey endorses today.

Yrefy

Sometimes the highest thing about higher education is the price. Seriously, student loans are out of control. When your private student loans are past due and you’re struggling to make any payments, it might feel like you can’t breathe. But don’t believe the myth that you can’t do anything about it.

There’s a way out: Refinance your private student loans with Yrefy. Yrefy doesn’t judge. They refinance defaulted private student loans other places won’t touch, and give you a custom, fixed-rate loan built for you, based on your ability to pay.

Yrefy is not licensed by the California Department of Financial Protection and Innovation. Yrefy is not authorized by the New York State Department of Financial Services to service any New York loans. Funding may not be available in all states.

Health Trust Financial

Health insurance can be confusing. Deductibles? HSAs? Part D? Who can help you understand all that stuff and make sure you don’t get gypped?

Health Trust Financial, that’s who. Health Trust Financial is the ONLY company Ramsey recommends to find you the best health insurance. They don’t work for the insurance companies—they work for you! While other companies are just after premiums, Health Trust Financial cares about taking the time to educate you, saving you money, and shopping different providers to find you the RIGHT health insurance.

NetSuite

Business is gaining momentum—but sometimes it seems like the wheels are about to come off. Communication breaks down because different systems have different “sources of truth” for key performance indicators. If that sounds like your business, you should upgrade to NetSuite by Oracle.

NetSuite is the top cloud financial system for streamlining accounting, financial management, inventory, HR and more. For 25 years, they’ve been helping businesses manage risk, get reliable forecasts and improve margins. NetSuite is everything you need for better decisions, all in one place.

Churchill Mortgage

Buying a home is the biggest investment most of us will ever make. You want your home to feel like a blessing—not a burden. That's why we tell people to contact Churchill Mortgage.

Despite what you may have heard, getting a mortgage is not a button push—it’s a process. Whether you’re buying your first home, an investment property, or you’re looking to refinance, it takes a relationship with an expert you can trust to help you do things the Ramsey Way. Churchill Mortgage is RamseyTrusted because they know your house can be a forever home, but your mortgage shouldn’t be forever. Their mission is to help you achieve your dream of owning your home free and clear.

Zander Insurance

Every smart financial game plan should include term life insurance, ID theft protection and long-term disability coverage. Our team has trusted Zander Insurance to provide those to you and your family for over 25 years. Zander shops the top-rated term life insurance companies to find you the best rates and coverage customized to your specific needs. With options to apply online or over the phone, the experience has never been easier. They even have low-cost life insurance plans that let you skip the medical exam.

Zander’s ID Theft Protection plans feature extensive prevention measures, including monitoring and alerts to make you aware of threats, full-service restoration if you become a victim, and even free coverage for kids on their family plan—all at the most affordable price in the industry.

Zander also helps you protect your greatest asset—your ability to earn an income—with affordable long-term disability insurance options that replace your paycheck if you become sick or injured and can’t work. No matter what kind of protection you need, go to zander.com as your one-stop shop for peace of mind for you and your family.

Mama Bear Legal Forms

Everyone needs a will. (Yes, even you.) A will is a great way to protect your family’s financial future and make sure your wishes are carried out to the letter when you die. If you don’t make a will, some random probate judge will decide who gets what. That’s not cool.

You also need medical and financial power of attorney documents, which name the people who can make decisions on your behalf when you need them to. Mama Bear Legal Forms makes it easy to get these legally binding documents online—and it takes just 20 minutes. Plus they’re specific to the state you live in. In the time it takes to drink a cup of coffee, unless you drink coffee really slowly, you'll have peace of mind knowing your family is taken care of. Visit

MamaBearLegalForms.com and use promo code Ramsey.

FREE sample of Financial Peace University? Game. On.

Countless Debt-Free Screamers started their journey right here—with FPU. Now, experience it for yourself with a free 10-minute sample of the course. Get ready—it might just change your life.

About The Ramsey Show

Dave Ramsey started on one station in Nashville back in 1992, sharing practical answers for life’s tough money questions. Today, the show reaches over 18 million combined weekly listeners. He’s also the author of seven bestselling books and has reached over 1 million people through Ramsey Solutions live events. A lot has changed through the years, but Dave and his team's practical advice on life and money has remained consistent.